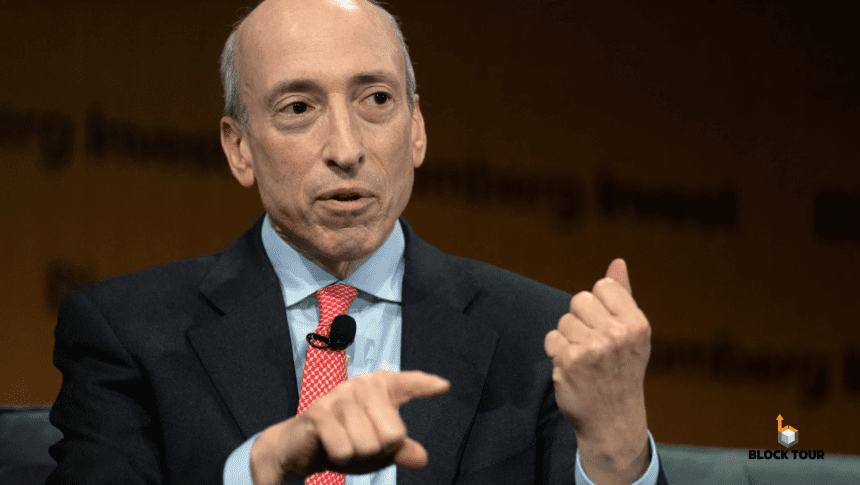

In a heated confrontation on Capitol Hill, U.S. Rep. Tom Emmer didn’t hold back, branding SEC Chair Gary Gensler as the most “destructive” and “lawless” leader in the regulator’s 90-year history.

During a Sept. 24 congressional hearing, Representative Tom Emmer fiercely criticized SEC Chair Gary Gensler, accusing him of inventing the term “crypto asset security” to fuel an enforcement spree targeting the crypto industry.

Emmer slammed Gensler for providing no legal definition or guidance on the term, which, according to Emmer, had been the foundation of Gensler’s crackdown for three years—until SEC lawyers quietly retracted the term in a recent court filing.

“This inconsistency has set our country back,” Emmer declared, calling Gensler’s tenure at the SEC the most “historically destructive” ever.

Emmer also took aim at Gensler’s handling of the Debt Box case, where the SEC accused the crypto startup of a $50 million fraud.

The case was dismissed in May, with the SEC ordered to pay $1.8 million in fees. Moreover, Emmer accused the agency of fabricating evidence to align with Gensler’s anti-crypto stance. In response, Gensler admitted the matter “wasn’t well handled.”

Further adding fuel to the fire, SEC Commissioner Hester Peirce joined the fray, stating the SEC should have long ago retracted the term “crypto asset security” rather than burying it in a footnote. She emphasized the SEC had failed in its duty to offer clear guidelines.

Gensler, meanwhile, faced additional pushback on the controversial Staff Accounting Bulletin (SAB) No. 121. Despite calls from 42 U.S. lawmakers to scrap the rule, Gensler insisted it helps companies understand crypto risks.

Also Read: The Fight To Define NFTs: Consumer Goods Or Securities?

Yet, critics like Rep. Wiley Nickel argue that SAB 121 could stifle U.S. banks from handling crypto assets, increasing risks by shifting control to non-bank entities.

While Gensler defended his stance, Nickel pointed to exemptions granted to large banks like Bank of New York Mellon, accusing the SEC of operating with “different rules for different folks.” Gensler, however, stood firm, asserting the rules remain consistent for all.