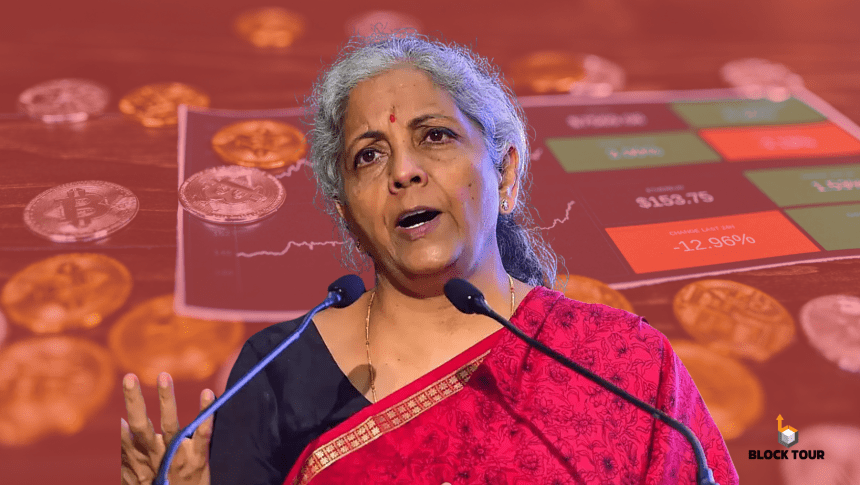

The Indian crypto audience is once again left hopeless as Finance Minister Nirmala Sitharaman announces the Union Budget for the new financial year.

Sitharaman’s Union Budget speech on July 23, 2024, did not address cryptocurrencies, maintaining the current tax regulations. This silence maintained the status quo for the crypto industry, preserving the existing 1% Tax Deducted at Source (TDS) which has been a significant deterrent to its growth.

Domestic crypto advocates had been pressing for a substantial reduction in the TDS rate to 0.01%, arguing that the current tax burden has hindered the industry’s development. However, their appeals fell on deaf ears.

This stringent tax policy is considered one of the toughest globally and is believed to have caused a sharp decline in trading volumes on Indian exchanges. Since the implementation of these measures, trading volumes have plummeted by 97%, and active users have dropped by 81%, as reported by the National Academy of Legal Studies and Research (NASLAR).

NASLAR’s research highlights that the national treasury is losing approximately 59 billion Indian rupees ($700 million) in tax revenue due to reduced activity on major Indian exchanges. It suggests that reducing the crypto TDS to 0.01% could potentially double the government’s earnings.

While the crypto sector’s request for a tax reduction was ignored, Sitharaman proposed reducing the TDS from 1% to 0.01% for e-commerce operators. This was not unexpected, as the government has repeatedly warned against the risks associated with cryptocurrency trading.

The government’s stance on cryptocurrencies mirrors the Reserve Bank of India’s (RBI) long-standing skepticism. The central bank has consistently expressed concerns about the speculative nature of crypto assets and the potential risks associated with them. The RBI’s May 2024 bulletin reiterated this viewpoint, extending its critique of decentralized finance (DeFi) as primarily speculative rather than transactional.