The US officials are back on the commodity versus security debate surrounding crypto.

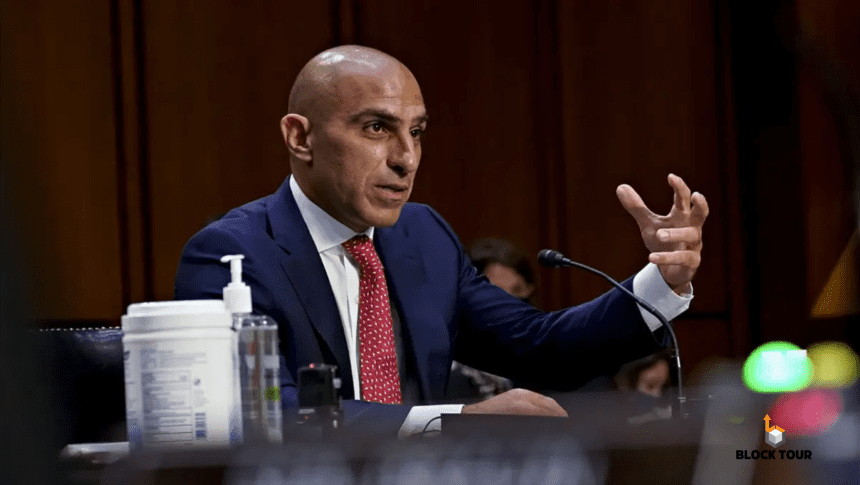

At a U.S. Senate hearing on Wednesday, the Commodity Futures Trading Commission (CFTC) Chair, Rostin Behnam, said Bitcoin, Ethereum, and many other cryptocurrencies should be regulated as commodities, not securities.

“In 2022, a Financial Stability Oversight Council report highlighted that there is a gap in regulation of the spot market for digital assets that are not securities. Given the risks that this unregulated market poses to U.S. investors, I have consistently and publicly called for new legislative authority for the CFTC, including before this Committee.”

According to Fox Business reporter Eleanor Terrett, Behnam believes that 70% to 80% of cryptocurrency assets are not securities.

Behnam mentioned that earlier this month, a federal court ruled in favor of the CFTC’s charges against a $120 million Ponzi scheme involving Sam Ikkurty from Oregon. Importantly, the Illinois district court judge classified BTC, ETH, and two lesser-known altcoins — Olympus (OHM) and KlimaDAO (KLIMA) — as digital commodity assets.

Judge Rowland, in his decision, highlighted the “core characteristic” these cryptocurrencies share with “other commodities whose derivatives are regulated by the CFTC.” This similarity, according to the judge, allows the CFTC to extend its authority beyond “future” contracts for commodities to encompass “spot commodity fraud.

While acknowledging the need for DeFi (Decentralized Finance) regulation, Behnam believes centralized exchanges should be the primary focus. He stated his belief in a “regulatory nexus for DeFi,” but suggested a “unique look” might be necessary due to its distinct nature.

Tensions have been on the rise between the CFTC and SEC over crypto asset regulation.

In January 2018, the CFTC and SEC issued a joint statement to combat fraud in digital currency markets, following the launch of regulated Bitcoin futures under CFTC oversight. The same year, William Hinman, head of the SEC’s Division of Corporate Finance, declared Bitcoin and Ethereum to be sufficiently decentralized to be considered commodities.

In February 2020, CFTC Chairman Heath Tarbert confirmed that both Bitcoin and Ether are commodities under the Commodity Exchange Act.

In February 2021, regulated ETH futures launched on the Chicago Mercantile Exchange under the CFTC’s oversight.

The classification of cryptocurrencies as securities or commodities significantly impacts their regulation. Securities, regulated by the SEC, include stocks and bonds and must adhere to strict disclosure and registration requirements if they qualify under the Howey Test.

Commodities, regulated by the CFTC, include raw materials like gold and wheat and are typically interchangeable or fungible. Cryptocurrencies deemed as commodities face less stringent regulations, with the CFTC focusing on fraud and market manipulation. This distinction influences how cryptocurrencies are issued, traded, and regulated, affecting compliance and investor protection.

The CFTC chairman ended his speech by urging Congress to grant the agency more authority over the crypto sector, including the spot cryptocurrency market.

He further stressed that nearly half of the agency’s enforcement actions in fiscal year 2023 involved allegations related to digital assets. He specified that out of 47 such actions, 35 targeted misconduct within the spot market for digital asset commodities.