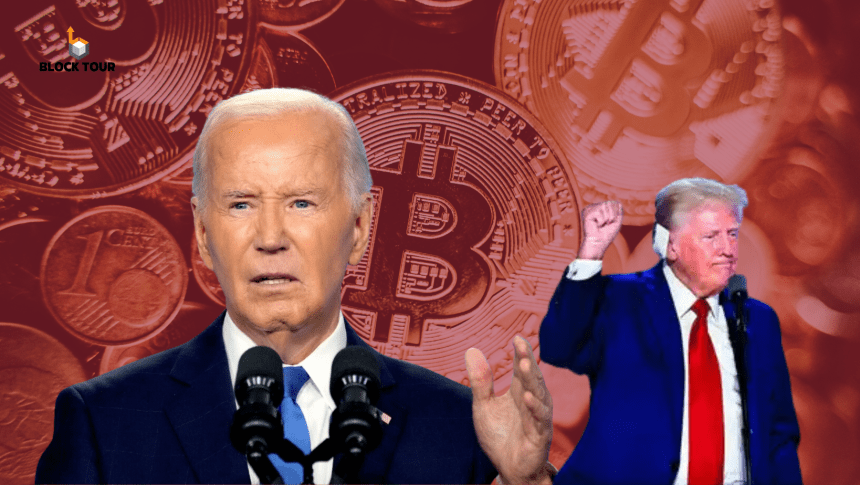

Yesterday, in a shocking turn of events, US President Joe Biden announced that he will no longer be running for a second term in the White House. How will this affect the crypto market? Analysts respond.

Some analysts believe that the last-minute move could benefit Bitcoin and other crypto assets in the upcoming months, while others caution investors. The price of Bitcoin initially dropped by up to 2.8% following the announcement but has since rebounded from the $65,800 mark, gaining over 3.6% in the past 8 hours, according to TradingView data.

eToro market analyst Josh Gilbert noted that Biden’s sudden move could be seen as a positive for crypto assets. He mentioned that Trump’s increased chances of reelection could significantly boost the asset class, noting that as Trump continues to lead in the election odds, crypto assets are likely to reflect this in their pricing.

“It’s difficult to envision Kamala Harris or another Democrat candidate overturning Trump’s lead in the polls with just three months left in this election race, but a lot can happen in that time frame, so nothing is off the cards.”

Trump has recently integrated Bitcoin and cryptocurrencies into his reelection campaign, promising on June 14 to end the Biden administration’s “war on crypto” if he is elected president.

Markus Thielen, founder of 10X Research, suggested that a crypto-friendly Trump might surprise the audience by announcing that he would make Bitcoin a strategic reserve asset for the US government at the upcoming Bitcoin 2024 conference in Nashville on July 25.

In a July 21 report, Thielen noted that the US government currently holds just 212,800 BTC, approximately $15 billion worth, compared to around $600 billion in gold reserves. If the government doubled its Bitcoin holdings, it would have a “nearly equivalent” price impact to the net inflows into spot Bitcoin exchange-traded funds (ETFs) year-to-date.

Looking ahead, Gilbert anticipates that the price of Bitcoin will continue to rise, citing the upcoming launch of spot Ether ETFs in the US as a key driver for market growth.

On the other hand, some analysts believe the recent Biden development might not immediately benefit the crypto market.

Swyftx analyst Pav Hundal cautioned that while Biden’s withdrawal could improve Trump’s chances. Similarly, Gary Black, Managing Partner at The Future Fund, advised his 433,000 followers on X that a Trump presidential victory is not guaranteed.