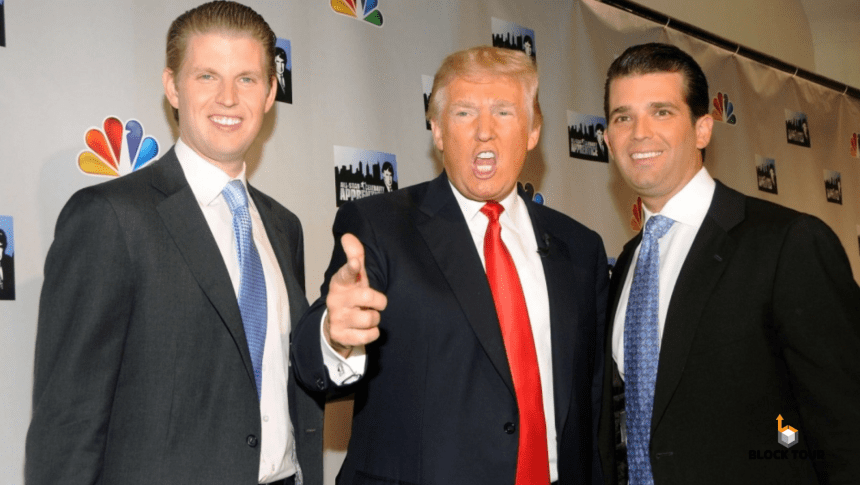

The Trump family’s new crypto lending venture, World Liberty Financial is promising to democratize finance.

World Liberty Financial, a new crypto lending platform endorsed by former U.S. President Donald Trump and his sons, is positioning itself as a financial revolution, claiming to “put the power of finance back in the hands of the people” and challenge what it calls a “rigged” traditional financial system.

However, a deeper look at the project’s draft white paper paints a different picture.

As per the crypto market latest news, the white paper reveals that a staggering 70% of WLFI, the platform’s governance token, will be held by the project’s founders, team, and service providers.

That leaves only 30% for public sale, with some of the funds raised from this sale also earmarked for insiders. A portion of the funds will go to a treasury to support the platform’s operations.

To put this in perspective, such a high insider allocation is rare. Ethereum’s initial token distribution allocated just 16.6% of its ether supply to the Ethereum Foundation and early contributors, with co-founder Vitalik Buterin later noting they received even less.

Cardano’s launch saw 20% of ADA tokens reserved for its three founding companies. Meanwhile, Bitcoin’s creator, Satoshi Nakamoto, holds an estimated 5% of the total Bitcoin supply.

When asked about the unusually high insider allocation for World Liberty Financial, one industry expert remarked: “LMAO. Nice joke, ser.”

Despite these details, World Liberty Financial hasn’t finalized its plans. A spokesperson acknowledged that while many contributors are involved, the tokenomics are still under development. They advised following the platform’s official channels for final updates.

In latest crypto news, these token distribution details also raise broader questions about the project’s intent. Is this truly about financial decentralization, or merely leveraging the Trump family’s fame for profit?

Historically, funds from pre-sales in the crypto space have been reinvested into projects to drive growth. If the majority of World Liberty Financial’s funds are being held by insiders, how will the platform deliver on its promises?

One of the platform’s grand promises is to make the U.S. the “crypto capital of the planet.” In a recent statement, the team confidently asserted that its plans would “speak for themselves” and that top minds in the crypto space are backing the project. They emphasized their commitment to driving mass adoption of stablecoins and decentralized finance (DeFi) while making it accessible and secure for everyone.

Interestingly, World Liberty Financial’s token offering differs from traditional initial coin offerings (ICOs). The WLFI token will be non-transferable, meaning it cannot be traded between users—a move likely aimed at avoiding securities law violations.

This approach also stands out in an industry where public token pre-sales are becoming increasingly rare, largely due to regulatory scrutiny and past issues with fraud in ICOs.

Nic Carter, a well-known crypto figure and Trump supporter, raised concerns on X that World Liberty Financial could harm Trump’s political image and attract hackers or regulatory scrutiny. A failure or hack could lead to significant blowback for both Trump and the broader crypto industry.

The big question remains: can World Liberty Financial truly deliver on its bold vision, or is it another attempt to capitalize on celebrity clout in the ever-evolving world of crypto? Only time will tell.